What is Orginal Medicare?

Original Medicare is the United States’ federal health insurance program for people who are 65 or older. It is also available for certain people younger than 65 with disabilities or people with End-Stage Renal Disease. There are several parts to Medicare that contain different coverage.

What is Part A?

Medicare Part A covers inpatient hospital care, skilled nursing, hospice, surgery, and home healthcare. Deductibles and cost-sharing will apply. Most folks will not have to pay Part A premiums.

What is Part B?

Medicare Part B covers doctor visits, preventative, outpatient services, and lab tests. Deductible and cost-share will apply. Part A and B comprise what is known as “original medicare.”

What is Part C?

Part C, also known as Medicare Advantage, takes the original medicare and privatizes it. In other words, a Medicare Advantage plan bundles Part A, Part B, and usually Part D into one single comprehensive plan with a private carrier.

What is Part D?

Medicare Part D is also known as prescription drug coverage. Part D coverage is available as a Stand Alone Option (PDP) or as part of a Medicare Advantage plan (Part C). Part D plans are offered by private insurance companies contracted and approved by Medicare.

Don't Risk Getting the Wrong Coverage

Brian Penner understands the Medicare enrollment process can be difficult tounderstand. This is why we strive to educate and empower our clients to make the best decisions for their health insurance coverage.

Call 970-840-0420 or better yet, schedule your appointment today.

What are Medicare Supplements?

Medicare Supplement plans, also called Medigap, are designed to work with Original Medicare Parts A and B. Medigap policies help pay for some health care costs not covered by Original Medicare, such as deductibles, coinsurance and foreign travel emergency.

These plans are offered by private insurance companies and are available to people with Medicare Part A and B. People with Original Medicare and a Medicare supplement can choose any stand-alone Part D prescription plans to pay for their drugs. People who are enrolled in Medicare Advantage plans (Part C) are not eligible for a Medicare Supplement insurance policy.

What is Medicare Part D?

Medicare Part D is Medicare’s prescription drug benefit that provides outpatient drug coverage. Part D is provided through private insurance companies contracted with the federal government.

If you want Part D coverage, you have to either buy a standalone plan or get it through a Medicare Advantage plan.

What Drugs are Covered?

Prescription Drug Plans and Medicare Advantage Prescription Drug Plans cover all vaccine drugs when necessary to prevent illness. Other than that, you will have a formulary unique to your plan that details what drugs are covered. So, before you choose a plan, you need to talk to a licensed Medicare specialist like the ones at Medicare Plan Saver to make sure all the drugs you require are covered with your plan.

What are the Different Plans?

Depending on your plan, this answer will differ. However, these are some drugs that will most likely not be covered under any prescription drug plan:

• Weight loss or weight gain drugs

• Any drugs for hair growth

• Fertility drugs

• Drugs for erectile dysfunction

• Any over-the-counter drugs

Also, if your Medicare Part A or B plan is going to foot the bill, Part D does not offer coverage.

You are Notified of Any Changes

You can rest assured that all Medicare Prescription Drug Plans are required to publish any changes to its formulary on the plan’s website. The insurance company must also tell you when drugs are removed from the Part D formulary.

All plans are restricted from making changes to the drugs provided and making price changes between the beginning of the annual election period until 60 days after coverage begins. The only exception is if the FDA determines a drug is unsafe or the manufacturer ceases production of the drug.

Also, any changes must include the name of the drugs removed, if the drug changes tiers, the reason for the change, alternate drugs available, any cost sharing, and exceptions available.

Your Rights to a Prescription Drug Plan

Once you purchase a prescription drug plan, you have the right to:

• Receive a written explanation from your plan about your benefits

• Ask for exceptions if a drug you need is not covered by your plan

• Ask for exceptions to waive coverage rules

• Ask for lower copayments for higher-cost drugs if you or your prescriber believe you can’t take lower-cost drugs for your condition

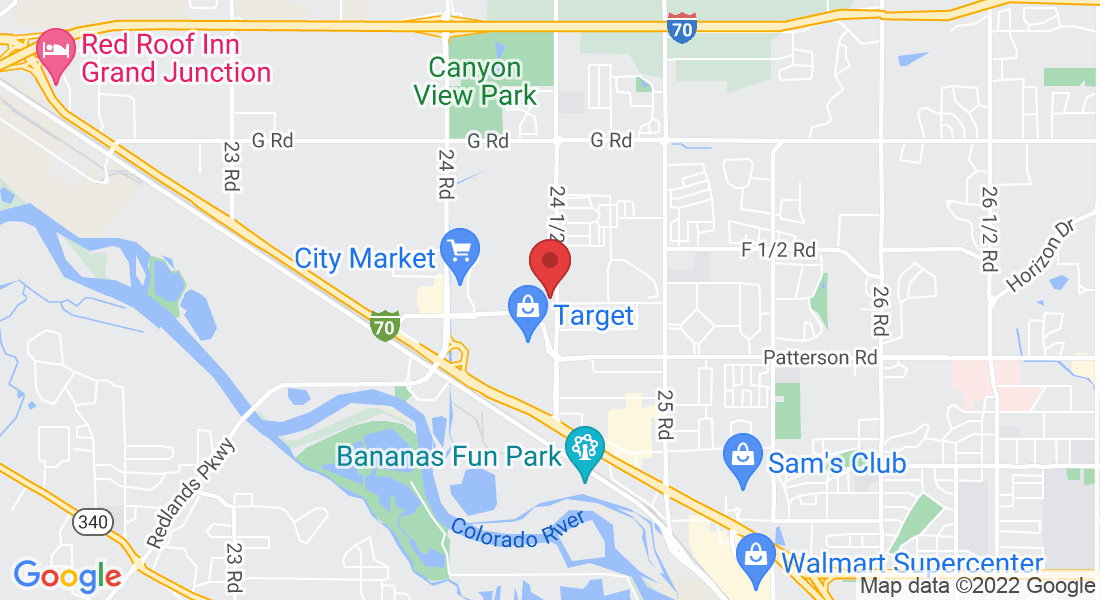

Brian Penner's office is located across from the Goodwill

CO license # 388109.

Not affiliated with or endorsed by the government or federal Medicare program. By providing your information in the above form, I grant permission for Brian Penner, a licensed insurance agent to contact me in regards to my Medicare options which includes Medicare Supplement, Medicare Advantage, and prescription drug plans. We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.